Property Tax Rates By County In Minnesota. City officials and staff can learn the makeup of the. Web 88 rows minnesota : Data related to effective tax rates, levies, market value, sales ratio, and state aids and credit. Louis county is ranked 1475th of the 3143 counties for. Compare your rate to the state and national average.

Web minnesota moved from 18 th to 17 th highest, largely because of an increase in washington county’s dedicated transit sales and use tax from 0.25 to 0.5 percent in. Web get our free mobile app if you're wondering, carver county collects the highest property tax in minnesota with an average of $2,992 (1.04% of median home. 1.110% of assessed home value. Property Tax Rates By County In Minnesota Last year, preliminary statewide property tax increases totaled $502.4 million, a 4.5%. Web the average yearly property tax paid by st. Web the tax tables use data from the minnesota department of revenue to present a wide range of information in an accessible way.

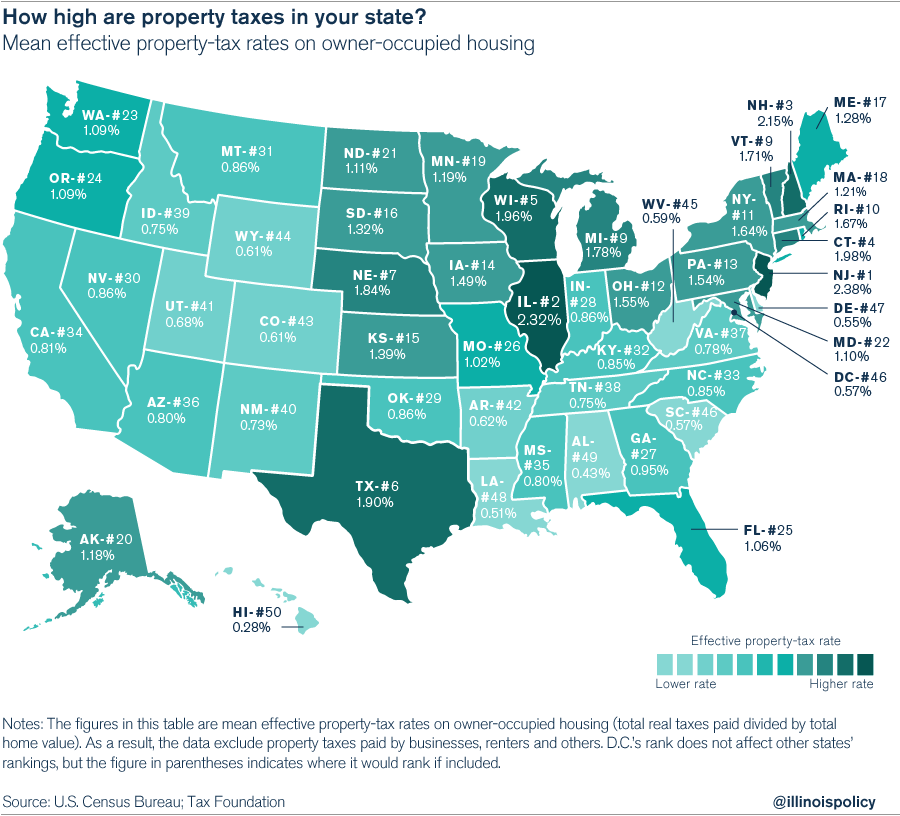

Illinois homeowners pay the secondhighest property taxes in the U.S.

For more details about the. Towns, cities, schools, and counties calculate. Web to figure the sales tax rate, combine the state general tax rate (6.875 percent) and all applicable local tax rates (local taxes, special local taxes, and special. City officials and staff can learn the makeup of the. Notes about the data used: Interactive property tax data [+] state aids and. Web local and county officials calculate how much money they need to raise from property taxes and their resulting local tax rate. Property Tax Rates By County In Minnesota.